The freight industry has undergone significant changes in the last couple of decades. Considering the recent closures in the sector, this has highlighted the vulnerability of many companies. Exploring the ebbs and flows unveils insights into how the economy has evolved in recent years, leading to multiple trucking companies closing.

What is a Freight Brokerage?

Freight brokerages do not own trucks, trailers, or equipment. But what they do have is buying power. Ultimately, a freight broker acts as a middleman, with buying power for smaller shippers who may not have the time or resources to engage directly with freight trucking companies.

How do freight brokerages help shippers?

Freight brokers play a vital role in the supply chain, seamlessly connecting shippers with trucking companies. They offer shippers flexibility, determine efficient and cost-effective tactics to move freight and provide expertise. According to Inbound Logistics, 83% of 3PL companies say they help shippers develop their supply chain strategies.

Consider a company that primarily ships locally. Their limited scale restricts their ability to negotiate directly with trucking companies. Limited personnel often prevents them from dedicating the time and resources required to manage complex operations.

This is where freight brokers serve as a solution, creating a bridge between shippers and trucking companies. Brokers can connect the shipper with suitable trucking options while also securing freight for carriers. Their extensive carrier network provides shippers with access to transportation providers.

Deregulation Sparks Brokerage Boom

Before 1980, trucking was heavily regulated by the Motor Carrier Act of 1935, which restricted backhauls. Thirty years later, the deregulation of the trucking industry changed the landscape for trucking as a whole, bringing a new type of business: freight brokers.

The Motor Carrier Act of 1980 was passed to reduce inflation and to give consumers more choices. The act allowed trucking companies to set their own rates and routes, making it easier for new trucking companies to enter the market.

While freight brokerages were initially slow to rise, it is estimated that only 6 percent of freight was handled in 2000. Brokers faced an accelerated market in 2020, and now they handle 20 percent of freight.

The Pandemic Freight Shock

After two months of the COVID outbreak, demand for overseas goods increased. An influx of imported goods from China and Southeast Asia created a boom in the freight market.

The shippers’ ultimate objective was to efficiently transport these containers between foreign and U.S. ports. With this goal in mind, container costs that once used to be $4,000 were now estimated at around $20,000 in import fees.

Ports, particularly Los Angeles, struggled to handle the high influx of cargo. This backlog at ports and container constraints led to inflated rates and logistical challenges.

While the freight boom revitalized international trade and fostered economic growth, it also exposed the vulnerabilities of the global supply chain industry. This period of supply chain disruptions highlighted the need for adaptability in supply chains.

Are we in a freight recession?

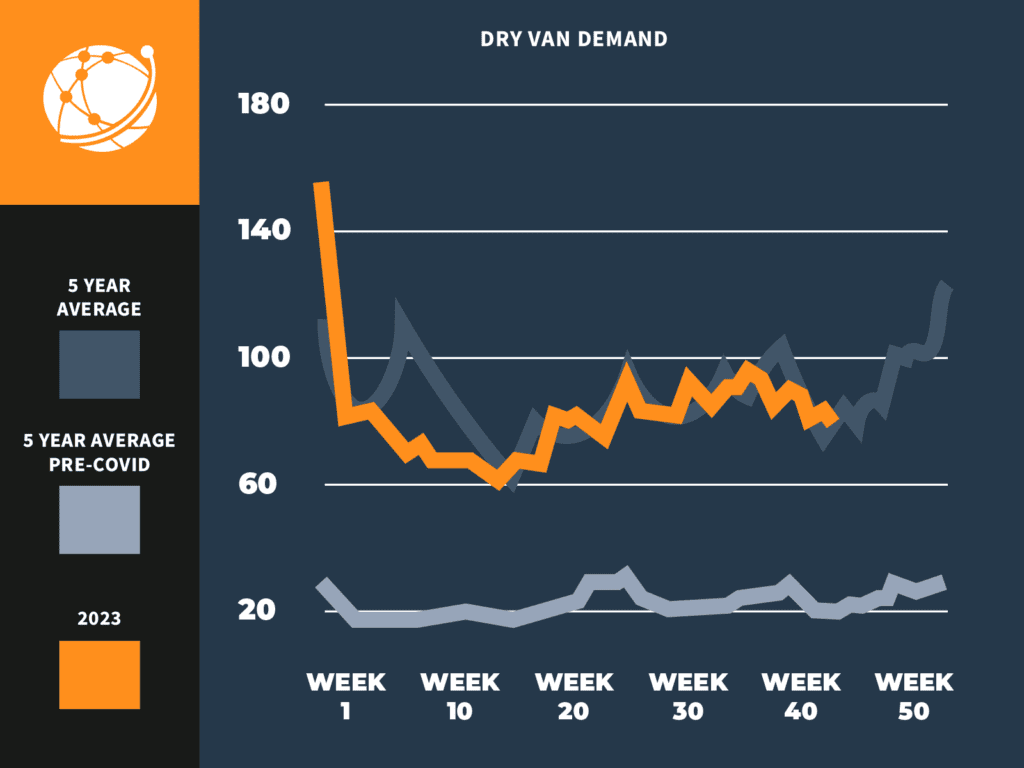

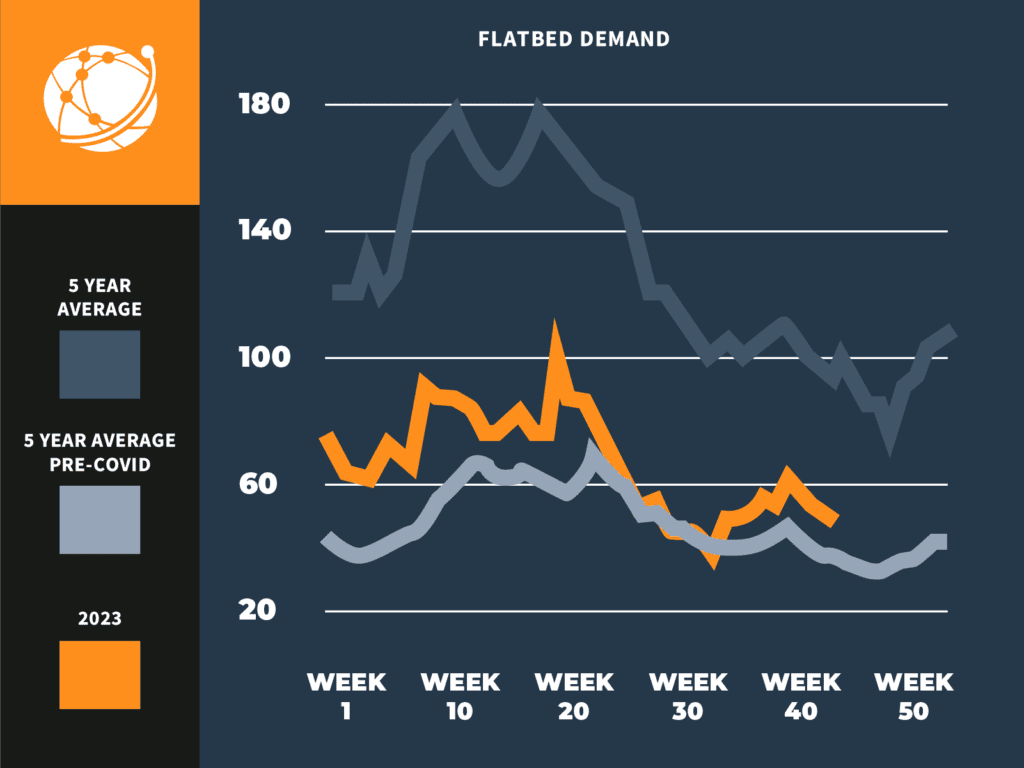

In the aftermath of COVID-19, the freight industry is gradually returning to normal. Trends are evening out. 2023 rates closely mirror the five-year average before the pandemic. Looking at dry van and flatbed demand, businesses can assume that demand is leveling out to the 5-year average.

The term “freight recession” might seem fitting to some, but in reality, it’s more of a correction. Rates are aligning with the industry’s historical norms, marking a return to stability.

The fall of freight brokerages and carriers

According to the Federal Motor Carriers Association (FMCSA), more than 1,500 freight brokers have closed in 2023. While the pandemic fostered growth for the transportation industry, it also disrupted many brokerages, leading to many shutdowns. One notable example that made headlines in the freight industry was the sudden closure of Convoy.

Convoy improved productivity with its digital freight automation for trucking companies and shippers. In April 2022, Convoy was valued at $3.8 billion, generating $800 million in gross revenue and around $136 million in net revenue at a 17% margin.

However, the company’s valuation didn’t necessarily align with the reality of its operations. The company’s downfall stemmed from being excessively overfunded, highlighting the consequences of being valued higher than the tangible value it could deliver.

Some experts speculate the downfall was rooted in an overemphasis on technology and a lack of long-term foresight and adaptability to a volatile industry.

The company’s rise and fall shows the importance for freight brokerages to strategically use their tech resources and continuously innovate processes. During challenging times, adaptability, transparent communication, and openness are crucial for a company’s success.

Creating successful shipper and 3PL partnerships

Many shippers are considering the use of freight brokers to promote their internal capabilities. 3PL partners help shippers to focus on their foundational strengths. Shippers and 3PLs can work collaboratively to create value for their operations and supply chains.

Sometimes, there is a huge misconception among shippers – if operations are working, it’s doing a good enough job. However, true success lies in operating not just adequately but excellently.

In a survey by NTT Data, 83% of shippers agreed that their relationship with 3PLs was successful. In the same survey, just over half of shippers reported they were increasing their use of outsourced logistics services.

As shippers go back to the basics for success, many are focusing on their core capabilities. Creating resilient supply chains and forming mutually beneficial partnerships are key drivers in this approach.

Navigating this shift requires adaptability and transparency. Building strong relationships with carriers is crucial. Honesty and open communication remain the foundation of success in this market as the industry resets to a “new” familiar.

How KCH Transportation brings value to customers

Companies that adapted during the pandemic thrived, proving the need for flexibility and openness to change. Learning from the past, it’s clear that complacency in a dynamic industry can lead to setbacks.

Many small-scale shippers lack the resources to maintain dedicated supply chain teams, often making operations less efficient. KCH Transportation leverages resources and time to propose innovative solutions, enhancing operational efficiency and cost-effectiveness.

As we navigate this changing landscape, fostering honest relationships between brokers, shippers, and carriers remains key.

Being flexible and adaptable is crucial in an ever-evolving industry. At KCH Transportation, we prioritize long-term relationships over short-term gains, recognizing that adaptation is key to success in this volatile environment.