Offshoring became popular nearly 60 years ago when companies moved their operations to obtain low labor and manufacturing costs. Now after decades of dependence on China, many countries are looking for manufacturing independence.

U.S. companies outsourced their labor to China for decades, but the COVID lockdowns reflected just how dependent not only the U.S., but countries around the world are on China. We saw a backlog of orders and shipping rates increased exponentially. Close-to-home sourcing can be helpful in oversight and quality control over production, improve speed to market, and a way to reduce overall supply chain expenses. The U.S. and other countries are going back to basics and gaining their manufacturing independence post-COVID-19.

Article Overview

Leading the charge

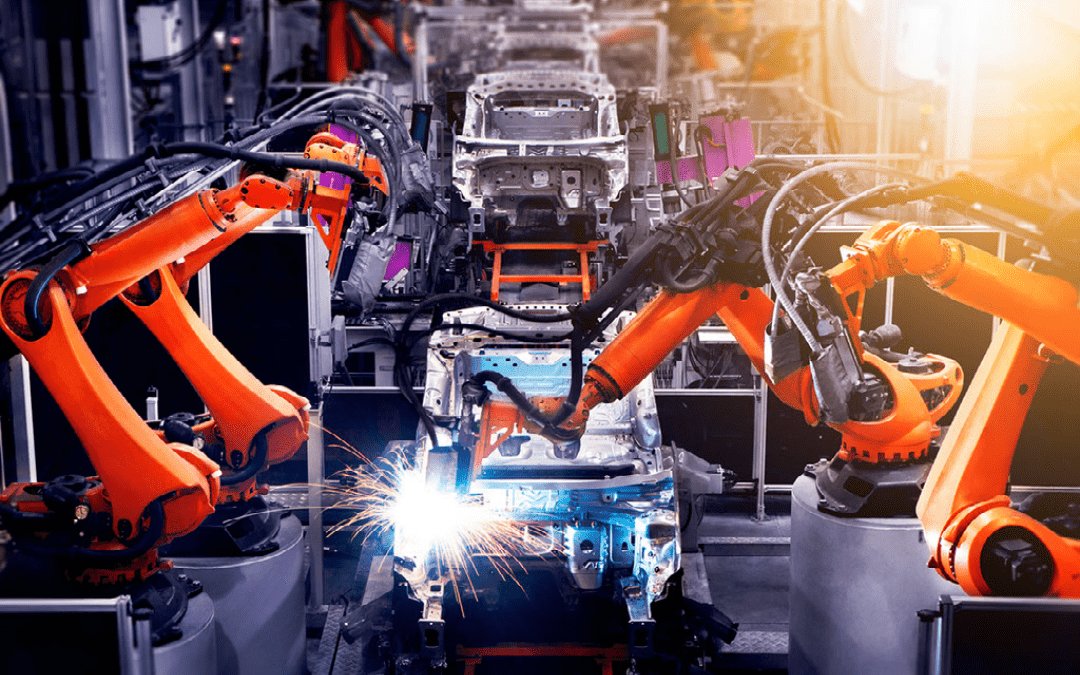

As countries work towards manufacturing independence, more companies are moving their operations to North America to be closer to the largest consumer market in the world — the United States.

Auto manufacturers such as Volkswagon see Canada as the prime location for their new electric vehicle production facilities and Tesla plans to build an electric battery facility in Mexico. While this is good for real estate and citizens looking for potential work in these countries, it will also create a safety net for markets that were hit hard by the intense lockdowns that China faced during the pandemic by creating versatile sourcing.

Investment in Mexico

The biggest advantage that Mexico has when attracting foreign investors is its proximity to the U.S., as well as a seat at the table in the United States-Mexico-Canada Agreement (USMCA), founded in 2020 as a successor to the NAFTA free-trade accord.

In the first nine months of 2022, foreign investment in Mexico reached $32.1 billion. Toy maker Mattel Inc., which manufactures Barbie dolls, grew its plant in between 2020 and 2022 in Monterrey, Mexico, into the company’s largest manufacturing facility worldwide.

Then, in January of 2023, Presidents Biden and Lopez Obrador were joined by Prime Minister Trudeau at the North American Leaders’ Summit in Mexico City and agreed to strengthen regional supply chains.

An additional benefit is the IMMEX program that was developed in response to the increasing rise in the popularity of manufacturing in Mexico in the last 20 years. The program issues a low-tax cost structure for companies that choose to plant their facilities in Mexico. The only condition is that all finished products will be exported out of Mexico within a timeframe the government deems appropriate.

The benefits of sourcing in Mexico range from affordable labor, to fewer environmental and governmental regulations, to tax reductions on building and construction.

Warehouses in Mexico built by companies headquartered outside of the country are nicknamed “maquiladoras”, which became increasingly popular in the 1990s after NAFTA was instated.

Canadian auto highs and retail lows

One industry whose future is extremely uncertain right now is the auto industry. To keep up with current sustainability trends, major manufacturers are all developing plans to offer more EV options in their lineups. Some auto manufacturers have been working out of Canada for quite some time, and others are just breaking ground to reap the benefits of Canada’s rich resources.

While Toyota has been investing in Canada for manufacturing since 1988, General Motors announced in 2020 that they would be investing 1 billion Canadian dollars in manufacturing to expand its pickup truck output.

Volkswagen also expressed its interest in Canadian real estate to be its primary location for its first international “gigafactory” to begin manufacturing batteries for its EV lineup. Volkswagen said that southwestern Ontario was the perfect location because of its access to raw materials and energy, as well as shared values on sustainability and responsibility.

The retail industry has tried and failed to break into Canada’s market due to certain geographical and economic hurdles. Big retailers like Target and Bed Bath & Beyond both found themselves closing stores across the country after trying their hand in the market.

First, the population is not as dense in Canada. There are 39 million people across the entire country, while roughly 55 million people live in only the northeastern part of the United States. Secondly, the landscape is vast, and it takes a long time to deliver goods from one side to the other — especially in the wintertime.

Potential drawback

It is difficult to say if all of these projects will come to fruition and if they do, whether or not they will be profitable. E-commerce sales have slowed since the pandemic boom, and consumers are reportedly spending more on services than goods nowadays amid the ever-looming recession and inflation. The EV movement, and car sales in general, are encountering setbacks as well.

In the U.S., we saw Amazon pull back on its investment to build a new headquarters in Virginia, and domestic manufacturing demand shrunk in February of 2023 due to a drop in orders.

Construction-material prices rose 16% in 2022 compared to 2021, and industrial-property sales declined by 55% in the first two months of 2023 from the same period last year. These numbers certainly rain on the Biden Administration’s parade about wanting to make the United States the leading global manufacturer.

As e-commerce demand continues to slow, it raises the question of whether or not growth in manufacturing will be necessary to handle current and future demand.

There is a mountain of risks that come with nearshoring your manufacturing to one of these countries in North America. However, trying to maintain operations in Asia may not be the answer either.

Reshoring operations closer to your target market is the first step, but companies should also focus on adapting their manufacturing processes overall to be more sustainable and fit the current environment.

A circular solution

The disruptions in the supply chain from the U.S.-China trade war followed by the pandemic, caused companies to reevaluate their distribution channels.

To adapt to a new market, companies can see additional revenue from costs and even lower environmental emissions from their supply chains by adopting a circular method. Circular manufacturing creates a reduction in unused materials by circulating them back through the economy instead of discarding them. This method does encourage reshoring efforts to reduce environmental impacts through reuse while at the same time localizing their distribution.

For this method to be successful, manufacturers need to expand their reuse strategies by not only reusing the products that they manufacture but also the resources that they rely on to sustain their manufacturing infrastructure. Research from Gartner points to a waste-free supply chain by 2029, and the World Economic Forum expects a complete elimination of the circular economy by the 2030s.

As countries continue to move their manufacturing and hopefully implement more of a circular business model, the days of depending on a single country and polluting the planet through waste and faraway trade lanes will be a thing of the past.