The global supply chain witnessed a tumultuous year in 2023, with significant changes across all modes of transportation. From inflation and labor issues to strategic cargo theft and environmental initiatives, the industry faced a complex landscape. For the outlook of 2024, understanding these key trends is paramount for navigating the future of logistics.

Article Overview:

As the horizon for 2024 remains uncertain, this outlook offers a forecast of what shippers can expect. It delves into the unique challenges and opportunities across trucking, ocean, rail, and air. It provides valuable insights into how key dynamics will shape the future of global commerce.

Carriers and 3PLs make tough decisions in shifting market

“Economy” was ranked as the number one concern by The American Transportation Institute. Inflation has been a hot topic for everyone. The demand for higher wages was highlighted by the tense contract negotiations with multiple unions.

However, shortly after reaching a contract agreement, Yellow Corp. filed for bankruptcy in August. As the third-largest less-than-truckload (LTL) carrier with an estimated market share of 8–10%, Yellow’s closure caused a scramble for many 3PLs and shippers to source a new LTL carrier. FreightWaves reported in October that a Morgan Stanley survey cited that 35% respondents said they are still looking for a permanent carrier replacement for their LTL.

Starting in July, the unemployment rate for the Transportation and Warehousing sector began to exceed the overall U.S. unemployment rate. Data from Federal Motor Carrier Safety Administration (FMCSA) also showed that 18,078 fewer carriers and 1,907 fewer brokerages were operating in October than in December 2022. In comparison, between December 2021 and December 2022, there was an increase of 19,998 carriers and 2,552 brokerages.

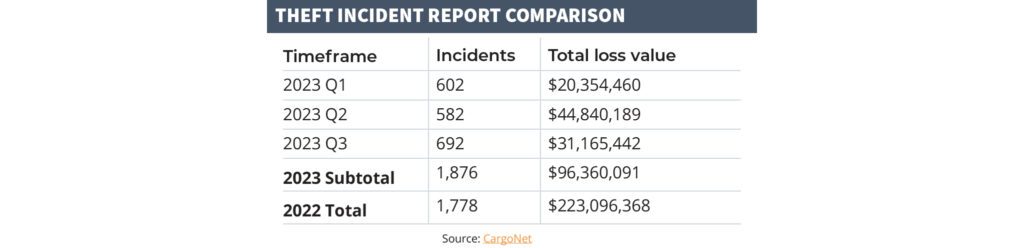

Rate of cargo theft grows

An unwelcome trend that emerged this year was an increase in cargo theft incidents. By the beginning of Q4, the number of theft incidents had already exceeded 2022 by almost 100, according to CargoNet.

One contributing factor is the surging rate of “strategic cargo theft. This is where criminals steal the identity of brokerages or carriers to misdirect cargo to steal. CargoNet notes in its Q3 trends analysis, that “documented strategic cargo theft events increased 430% year-over-year.”

Electric Vehicle initiatives impacting the future of trucking

In 2021, President Biden set “an ambitious target of 50% of electric vehicles (EV) sales in the U.S. by 2030.” This year, more initiatives were made to take steps toward that goal, specifically in California.

The California Air Resources Board (CARB) took action to end the sales of combustion trucks by 2036. Specifically, all drayage, local delivery, and government trucks must be zero-emission by 2035. To help comply, the Port of Los Angeles and Port of Long Beach have set up a voucher program. The voucher program will provide up to $100,000 per truck for the purchase of zero-emissions Class 8 drayage trucks. These trucks will operate at the San Pedro Bay ports complex.

What shippers should know going into 2024

Experts are split on LTL rates come next year. From Logistics Management’s LTL study, 57% said LTL rates will increase over the next 12 months. But according to the CNBC Supply Chain Survey, 33% said rates would be up 5%, but another 33% said rates would be down 5% and 17% responded it would be down 15%.

In the same survey, 33% of responders predicted a 5% increase in rates for full truckload (FTL). Also, a collective 51% was divided between anticipating rates to decrease by 5%, 10%, and 15%.

The U.S. Energy Information Administration projects diesel prices to decrease overall next year, which will be a welcomed relief after 2023 started with a U.S. average of $4.967.

Cargo theft still stands to be a concern in 2024, as there is little indication of rates slowing. Shippers should consult with their freight providers to ensure they are vigilant and using strategies to mitigate risk.

With 2024 predictions uncertain in trucking, ensuring your transportation partners are ready to adapt to changing circumstances will be imperative for uninterrupted, cost-efficient service.

Ocean freight demand down due to economic factors

As demand begins to level out after record high from pandemic-era shipping, ocean freight experienced a dramatic drop. According to PYMTS, daily market prices from Asia to the United States and Europe “dropped by as much as 90% since early 2022.” Maersk, a top container shipper, cited some reasons for the decline to be limited economic growth this year coupled with excess inventories. The National Retail Federation projected a 13.5% decline in import volume compared to 2022, reflecting the overall decline of retail sales this year.

Big investments to improve major ports

In 2022, the Biden Administration allocated $17 billion under the Bipartisan Infrastructure Law to support over 800 projects across 55 states and territories. Following approval, the Administration allocated $653 million aimed at upgrading ports nationwide. Notable grants included $43.4 million for a dock replacement in Alaska and investments in key upgrades for The Port of Long Beach, featuring a rail expansion, and $32 million for berth construction at the Port of New Jersey.

Additionally, the Environmental Protection Agency (EPA) pledged $4 billion to enhance U.S. port infrastructure, which focuses on reducing air pollution.

U.S. Reshoring and nearshoring initiatives begin

Responding to supply chain disruptions highlighted by the pandemic, U.S. manufacturers embarked on reshoring initiatives. The Reshoring Initiative® shows a clear shift toward Mexico, attracting 80% of nearshoring cases and 74% of associated jobs. A key driver behind this preference for Mexico is its high U.S. content in exports. Mexico has surpassed China, reaching 40%, compared to China’s 5%.

Manufacturers primarily focused on building semiconductor facilities, which increased construction spending in manufacturing. According to the Reshoring Initiative Report, EV battery and semiconductor investment account for the largest share of job announcements.

Many major U.S. companies, such as Boeing Co., Whirlpool Corp., Ford Motor Co., General Motors, and General Electric Co., participated in the reshoring trend. The Reshoring Initiative® also stated that around 90% (or 350,000+) of companies have actively started reshoring. As companies navigate bringing their manufacturing closer, adaptability will be a key factor in making their strategies successful.

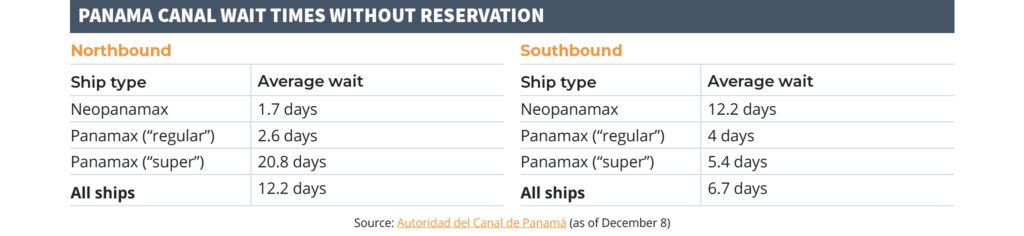

The Panama Canal drought causing bottleneck

The East Coast took a hit with the ongoing drought affecting the Panama Canal. According to CNBC as of November 3, some wait times have increased by 30%. The Panama Canal Authority has already announced a reduction in the number of reservation slots into 2024. As of December 1 the number of slots is down to 22 and is set to get as low as 18 in February 2024. By comparison, the number of reservation slots is typically 31.

Due to the limited number of ships able to pass through the canal, some shippers have resorted to paying millions to jump the line. While the cost seems excessive, the alternative is taking an alternate route that adds more time to transit, which in turn adds more cost.

What shippers should know going into 2024

In 2024, ocean freight is facing major potential disruptions with the Panama Canal drought, as the drought season doesn’t end until April or May.

Potential labor strikes may also cause disruptions in the coming year. The East and Gulf Coast union look to renew their contract at the end of September 2024. Shippers should proactively prepare by monitoring labor negotiations, diversifying shipping routes, embracing technology, and communicating with suppliers and customers. CNBC cites that the majority of supply chain leaders surveyed believe ocean freight rates will remain unchanged or decrease in Q1 and Q2. UPS mostly agrees, but also points out that global conflicts and oil prices may cause rates to go up.

Xeneta does warn that although depressed 2023 ocean shipping rates may sound good to shippers now, it could cost them in the long run. Shipping companies may prioritize their more lucrative contracts made in 2024 over “non-profitable” ones made in 2023. Shippers should be mindful of how this could affect their service and communicate with their freight providers before it becomes an issue.

Derailments spark rail safety concerns nationwide

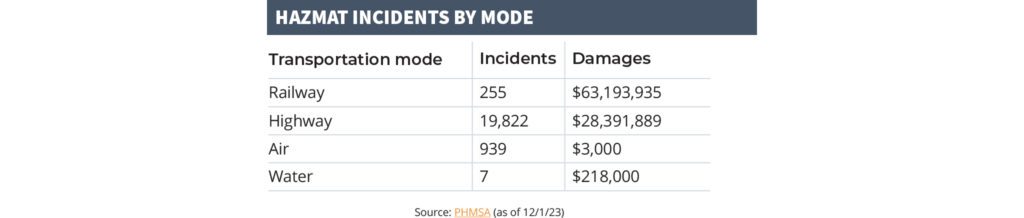

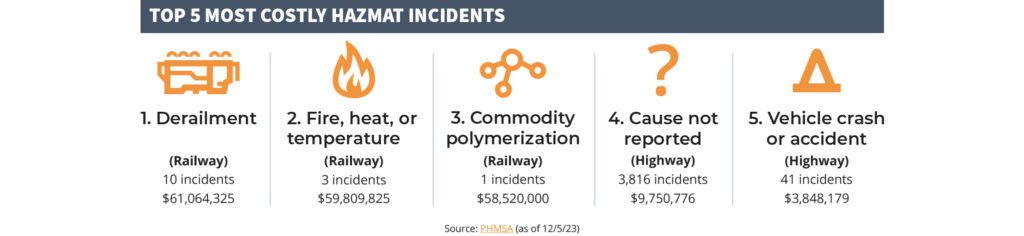

In February, the Norfolk Southern train derailment in East Palestine, Ohio made major headlines. The train carrying hazardous materials caught fire and contaminated waterways in the surrounding area. But according to the Federal Railroad Administration, 742 train derailments have been recorded in 2023 as of October, a decline from the previous year’s 1,259 derailments.

Although the rail hazmat incident rate is relatively low compared to highway, rail incidents are more costly. Rail incidents caused damages of over $63 million, whereas highway incidents caused over $28 million. Notably, rail derailments were among the costliest types of incidents, with the derailment in East Palestine alone costing over $58 million.

The highly reported derailments this year did spark law makers to introduce legislation in the form of the Railway Safety Act of 2023, but as of this writing it has yet to become law. If passed though, it would establish a minimum crew size of two people. Additionally, it expands safety precautions for transporting hazardous materials, and more.

Passenger rail initiatives impacting freight rail

This year, the Federal Railroad Administration allocated $16.4 billion to rail projects in the busy Northeast Corridor. Project upgrades include bridge replacements in Maryland and Connecticut that freight service use in addition to the passenger rail.

Mexico also prioritized passenger rail with a new mandate compelling private railway companies to add passenger service to their existing freight operations. The aim of this initiative is to make train travel more cost-effective and less harmful to the environment but could impact future freight operations. Railway companies have been given until January 15 to submit their proposals for offering the passenger service themselves.

Reciprocal Switching inches closer to finalization

In November, The Surface Transportation Board, proposed a rule change regarding Reciprocal Switching for Inadequate Service. As explained by Railway Age, “Reciprocal Switching means that a railroad with sole physical access to a shipper facility transfers shipper freight cars to a near-by junction point with a second competing railroad.” While shippers hope this will improve competition, railroads have voiced opposition for the change. The proposal has yet to be finalized, with the comments period set to end December 20.

What shippers should know going into 2024

Although there have been numerous initiatives announced in 2023, it is unclear when many will be put into effect. However, some changes are already expected come January 1. BNSF Railway, GMXT, and J.B. Hunt Transport Services Inc. plans to introduce a faster intermodal service between Monterrey, Silao-Bajio, and Pantaco-Mexico City regions in Mexico via Eagle Pass, Texas. For shippers, this initiative will improve operations, create faster turnaround times, and lower inventory costs. BNSF will also regain control of the Class II Montana Rail Link as of January 1.

Experts project that rail prices will continue to remain high into 2024. Railway Age does note that although lease prices are elevated, some car-types remain lower, such as coal and flammable tank.

Demand for air freight decreases in 2023

Air freight has not been spared in the trending decline in demand, with Xeneta reporting an 8% decline in demand of global air cargo compared to pre-pandemic rates. Major freight forwarders experienced a decline in revenue, notably Kuehne+Nagel’s revenue decreased by 65 percent.

Focus on sustainability

The International Air Transport Association (IATA) highlighted three key priorities for the air cargo industry at the 16th World Cargo Symposium: sustainability, digitalization, and safety. IATA is working to support the energy transition in the aviation industry by developing a standardized calculation for emissions and environmental, social, and governance (ESG) related metrics as well as expanding the IATA Environmental Assessments.

What shippers should know going into 2024

A potential disruption on the horizon is the ongoing pilot contract negotiation at Air Transport International (ATI), who provides services to Amazon and DHL. As negotiations stand as of November 14, “99.7% of union members voted in favor of a strike authorization.” However, federal laws typically safeguard against strikes in critical infrastructure industries.

Overall, shippers can expect more opportunities after the volatility within the past few years. According to UPS, air cargo should see a recovery in demand, with Accenture Cargo projecting 4.7% year-over-year growth in 2024. As for rates, those are likely to remain low for the first nine months of 2024, with the potential to grow and return to a high peak shipping season in Q4. CNBC’s survey also agreed, stating that they “anticipate rates to be unchanged to down anywhere from 10% to 20%.” Shippers should explore cost-effective air freight for fast and secure shipment while rates are low.

Key Takeaways

As we transition into 2024, shippers can navigate potential challenges by adopting a proactive approach. A few strategies to consider are diversifying shipping modes and routes, leveraging strong partnerships, and enhancing adaptability. Improving communication with suppliers, logistics providers, and customers can not only mitigate risks but create opportunities for growth. By investing time now into innovating processes, it will help continuity and resilience in the face of potential disruptions.

It is crucial for all supply chain managers to stay informed and proactive while navigating the uncertain year ahead. For example, capitalizing on low rates in air freight may be worth exploring, due to its speed and shipment security. By utilizing experts in your supply chain partnerships, you can manage expectations, mitigate risks, and find new opportunities to reach your 2024 goals. In an industry where conditions can change rapidly, having reliable partners to assist with your shipping needs is invaluable.